In businesses, Key Risk Indicators (KRIs) are a concept that has been introduced as a tool of paramount importance that organizations that aim at managing risk try to cope with. At its core, a KRI is a measurable value that helps organizations assess their exposure to potential risks. These indicators serve as early warning signals, allowing businesses to the root cause and acting accordingly will minimize the risks before they become significant problems. My risk factor perception will be improved by using numbers that will lead me to a direct threat to my company’s goals and overall performance.

Recognition and analysis of KRIs require an in-depth comprehension of both the internal and external environments where my company provides its services. Internal factors may involve such matters as standard procedures for task accomplishment, financial health, and employee performance, and, the latter, market trends, regulatory changes, and economic conditions can be mentioned as external factors. This is through the synthesis of data from all these sources that I can make robustly balanced and tailored KRIs that will portray the real risks to myself or my company. This vigor results not just from me but more so from my leadership built into a culture that is anchored in the importance of risk management and the responsibilities associated with it, as well as the atmosphere of collaboration created within my leadership team.

Importance of Identifying Key Risk Indicators

As a matter of fact, for any business that would like to thrive in a world of a turbulent environment, it is simply the most important thing to understand why KRIs are important. The identification of these indicators makes it possible for me to develop a risk-management framework that is both systematic and strategic. , Through the use of the indicators, I can focus on the biggest sources of risk and distribute the allocated resources more wisely. This approach speeds up the decisions made and lends the advantage of added capacity serving as a buffer to the entire organization. In addition, KRIs are fundamental to the integrity and communication

Common Key Risk Indicators in Business

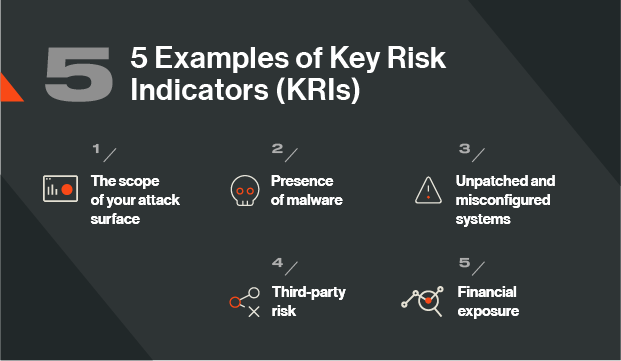

While I have been learning more about the different types of KRIs, I have noticed that many of them are used in different industries. Financial ratios like the liquidity ratio and profit margin typically govern the KRI debate. These indexes throw light on an entity’s financial well-being and, simultaneously, they can be a signal that the organization faces risks connected with solvency or revenue. Among the most important financial KRIs watched, I can know and predict such trends even before they start to pose a real threat. Among others, we have the key performance indicators for the operation sector, which are also of great importance. Metrics related to employee retention, production efficiency, and customer satisfaction surveys are some of the most obvious dangers that my team and I have to consider. For example, a high employee turnover rate indicates a deeper problem such as a bad company culture or inefficient management of resources in the workplace. Dissecting the process to these indicators, managing by exception, will be the thorough way for me to have that 360 view and hands-on management decision-making knowledge that will leverage the best performance for my organization.

Strategies for Identifying Key Risk Indicators

Key Risk IndicatorDescriptionMeasurementFinancial PerformanceShows the financial condition of the organization revenue, profit margin, cash flowOperational EfficiencyAssesses the extent to which processes are functioning effectively, time cycle, resource utilization compliance ViolationsSpotting the acme of breaching of the rules number of violations, fines imposedCustomer SatisfactionHere we take account of customers’ satisfaction. The higher the NPS, the more satisfied the customer, or vice versa et Promoter Score, customer complaints

One approach to identifying effective KRIs is to use a strategic method that combines data analysis with a deep understanding of the organization’s objectives and risk appetite. A successful way to do this is to engage in a comprehensive risk assessment process. To be able to do so, one must, firstly, identify the possible risks within a range of domains, such as financial, operational, strategic, and compliance, and then, secondly, assess their probability and impact on my business. Through performing this assessment, I can come up with the most applicable KRIs that are compliant with our risk profile. Another method is to make use of technology and data analytics tools for my KRI identification process. With the arrival of big data and advanced analytics that have given me a huge amount of data that can help me in my decision-making, I can utilize these resources. By the use of data visualization tools and predictive analytics, I can discover patterns and correlations not immediately apparent. This data-based method not only results in the accuracy of my KRIs but can also be adapted in real time as new data arises.

Implementing Key Risk Indicators in Business Planning

After I choose the KRIs that are relevant to my organization, the subsequent action will be the integration of them into our business planning processes. The integration is the most important aspect to ensure that our risk management will become an inseparable part of the strategic decision-making framework. A way that I can accomplish this is to put in place principles that will guide the monitoring, reporting, and acting of KRIs in my organization. The most feasible technique for implementing KRIs would be by including them in our performance management systems. A perfect pairing of KRIs and key performance indicators (KPIs) creates a contiguous framework that connects risk management with the performance of the whole business. Such a fitting assures that the team is on sum with the strategic goals and risk management is aligned. Besides, the periodic examination of KRIs during the strategic planning meetings can help us stay agile and be more compliant with the constantly changing people and market environment.

Monitoring and Managing Key Risk Indicators

Regular Review and Adaptation

Deciding to hold the top management accountable periodically by implementing a regular review procedure for KRIs is crucial, say that it should be about once a week when the team has to document the current situation of the company in terms of the respective key figures, should it be done descriptively or should it be done just for the life-time of an expression only. The latter has to be agreed on and, to ensure that all parts of the control machine properly interact, should be examined.

Proactive Risk Management

A deciding factor for thoughtful management of KRIs is coming up with workable, realistic schemes that have to be done in case of a sign of high risk. I can illustrate it by stating that suppose a financial KRI shows a shortage of profit, I probably will be challenged with tasks like these: I submit the case in a way that takes care of your profits to minimize this issue. It can be done through cost-saving approaches, implementation of income growth options, or revamping the operation.

Mitigating Risks

Before a minor problem leading to a major crisis occurs, the best way to handle the KRI signals is for me to make my risk response operational and proactively prepare for any troublesome elements that may come up later.

Case Studies of Successful Key Risk Indicator Implementation

Checking out the outcomes of the deployment of KRIs in real-life situations will let the user draw the best experience guidance and experience learning. For example, a large scale multinational manufacturing company was caught up in the complex geopolitics affecting the world and had to manage significant supply chain disruptions. They found several weaknesses such as the existence of highly dependent relations on few suppliers, their inability to come up with alternative courses of action in case of the blockade, and also high oversupply of particular inventory.

Future Trends in Identifying Key Risk Indicators

One of the most pressing issues in the field of organization risk management is the efficiency, profitability, and competitive advantage of the business as informed from the leading trend of the KRI in the future. Several trends are going to be quite important regarding how organizations approach risk management. The most characteristic one is the higher engagement of artificial intelligence (AI) and machine learning (ML) technologies in the improvement of KRI analysis. In support of this, high-tech tools enable me to deal with large volumes of processed data very fast, hence, enabling me to identify the trends and also, find abnormal fluctuations that might be the signs of risks’ evolution with higher accuracy. The added value of environmental, social, and governance (ESG) elements is a focus of large interest among KRI developers. As the public awakens more and more on the importance of morals and being green, businesses’ mindsets should also center on ESG factors—thus the need to adjust and renew their risk management tools. Through ESG, metrics such as carbon emissions or the level of diversity and inclusion will be considered as the main drivers at my company for staying in good graces with the society on the one hand and, where applicable, identifying, and mitigating company-associated risks. Last but not least, knowing and executing Key Risk Indicators is a requisite for any enterprise that endeavors to be successful in the contemporary world of technology. I can boost my organization’s resilience and efficiency thanks to the assessment of valid KRIs and their incorporation into business plans, and the constant performance monitoring.

FAQs

What are Key Risk Indicators (KRIs)?

Key Risk Indicators (KRIs) are particular measurements used to oversee and gauge the potential danger exposure of an organization. Basically, they are utilized to give the primary signs of potential risk events and are useful in the active management of risks.

How are Key Risk Indicators different from Key Performance Indicators (KPIs)?

The main focus of Key Risk Indicators (KRIs) is on the monitoring and evaluation of potential risks, while Key Performance Indicators (KPIs) are the tools that show the performance and achievement of an association to meet its strategic objectives.

What is the importance of Key Risk Indicators (KRIs) in risk management?

The role played by Key Risk Indicators (KRIs) within risk management is accomplished by producing alerts or warnings of potential risk events. This is done by allowing the organizations to adopt early actions to mitigate the risks and to avoid the potential losses.

How are Key Risk Indicators (KRIs) identified and selected?

Key Risk Indicators (KRIs) are pinpointed through a comprehensive process of risk evaluation, which entails the identification of potential critical situations, the selection of the pertinent metrics to monitor those risks, and the setting of the thresholds for those metrics to trigger risk alerts.

What are some examples of Key Risk Indicators (KRIs) in different industries?

Key Risk Indicators (KRIs) samples may be in the service industry the customer complaints, inventory turnover in the manufacturing industry, the credit default rates in the financial industry, and employee turnover in the human resources industry.